乐彩汇-百顺牌波纹补偿器(波纹管,膨胀节,伸缩节)、非金属补偿器

|

网站地图

非金属补偿器非金属补偿器、织物补偿器是一种可补偿轴向、横向、角向,具有无推力、简化支座设计、消声减振的多功能产品,特别适用于热风管道及烟尘管道。百顺牌二十年的知名老品牌、购买贵的并非是对的,但河北伟业肯定是适合您的!

非金属补偿器非金属补偿器、织物补偿器是一种可补偿轴向、横向、角向,具有无推力、简化支座设计、消声减振的多功能产品,特别适用于热风管道及烟尘管道。百顺牌二十年的知名老品牌、购买贵的并非是对的,但河北伟业肯定是适合您的!

非金属膨胀节非金属膨胀节从外形结构上可以分为圆形,方形,矩形,我公司也平价提供蒙皮,为上千家用户提供服务,源头厂家直接供应。

非金属膨胀节非金属膨胀节从外形结构上可以分为圆形,方形,矩形,我公司也平价提供蒙皮,为上千家用户提供服务,源头厂家直接供应。

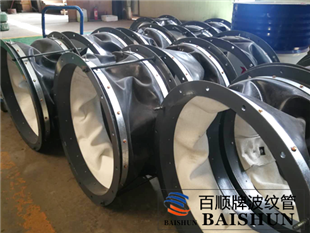

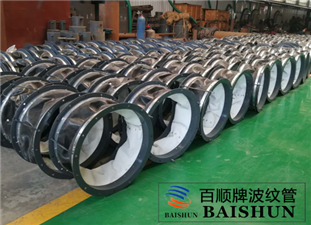

圆形大口径补偿器圆形大口径补偿器

圆形大口径补偿器圆形大口径补偿器

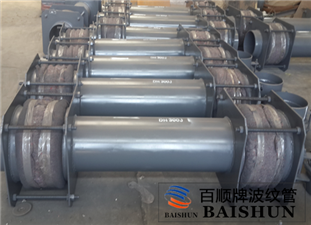

煤粉管道专用三维波纹补偿器(MSW型)煤粉管道专用三维波纹补偿器也称管道补偿器、管道伸缩器、波纹管膨胀节。管道补偿器是专为煤粉管道设计的一种专用补偿器。管道补偿器采用多层一次液压成型工艺,可以补偿轴向、角向、横向及各方位的合成位移。

煤粉管道专用三维波纹补偿器(MSW型)煤粉管道专用三维波纹补偿器也称管道补偿器、管道伸缩器、波纹管膨胀节。管道补偿器是专为煤粉管道设计的一种专用补偿器。管道补偿器采用多层一次液压成型工艺,可以补偿轴向、角向、横向及各方位的合成位移。

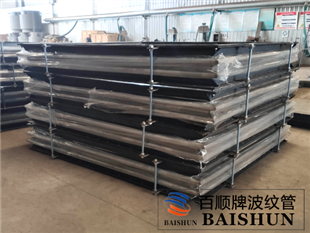

矩形波纹补偿器(JX型)矩形波纹管伸缩节(JX型)也称波纹伸缩器、矩形补偿器、矩形膨胀节。该波纹伸缩器/矩形波纹补偿器具有轴向、横向、角向补偿功能。伟业矩形波纹补偿器可根据客户要求定做。

矩形波纹补偿器(JX型)矩形波纹管伸缩节(JX型)也称波纹伸缩器、矩形补偿器、矩形膨胀节。该波纹伸缩器/矩形波纹补偿器具有轴向、横向、角向补偿功能。伟业矩形波纹补偿器可根据客户要求定做。

套筒式补偿器套筒式补偿器亦称管式伸缩节/管道伸缩器。套筒式补偿器/管式伸缩节是热流体管道的补偿装置,通过滑动套筒对外套筒的滑移运动,达到热膨胀的补偿。套筒式补偿器/管式伸缩节采用新型的密封材料柔性石墨环,其具有强度大,不老化,效果好,维修方便等特点。管式伸缩节的使用寿命长,疲劳寿命与管道相当。

套筒式补偿器套筒式补偿器亦称管式伸缩节/管道伸缩器。套筒式补偿器/管式伸缩节是热流体管道的补偿装置,通过滑动套筒对外套筒的滑移运动,达到热膨胀的补偿。套筒式补偿器/管式伸缩节采用新型的密封材料柔性石墨环,其具有强度大,不老化,效果好,维修方便等特点。管式伸缩节的使用寿命长,疲劳寿命与管道相当。

曲管压力平衡式补偿器(QYP)曲管压力平衡式补偿器也称曲管压力平衡膨胀节、曲管压力平衡式伸缩节,主要安装在管道的拐弯处或与设备连接的空间的管道上。它能补偿轴向位移、横向位移、而不会对管道系统产生内压推力。常用于泵、压缩机、汽轮机及其他对载荷敏感的管道系统。且能吸振降噪,让设备安全运行.

曲管压力平衡式补偿器(QYP)曲管压力平衡式补偿器也称曲管压力平衡膨胀节、曲管压力平衡式伸缩节,主要安装在管道的拐弯处或与设备连接的空间的管道上。它能补偿轴向位移、横向位移、而不会对管道系统产生内压推力。常用于泵、压缩机、汽轮机及其他对载荷敏感的管道系统。且能吸振降噪,让设备安全运行.

旁通压力平衡型波纹补偿器(PP)旁通压力平衡型波纹管(PP)又称为压力平衡波纹伸缩器、旁通压力平衡型膨胀节,具有吸收内压推力的能力,波纹补偿器具有良好的导向性、产品刚度小、外形尺寸小等特点。

旁通压力平衡型波纹补偿器(PP)旁通压力平衡型波纹管(PP)又称为压力平衡波纹伸缩器、旁通压力平衡型膨胀节,具有吸收内压推力的能力,波纹补偿器具有良好的导向性、产品刚度小、外形尺寸小等特点。

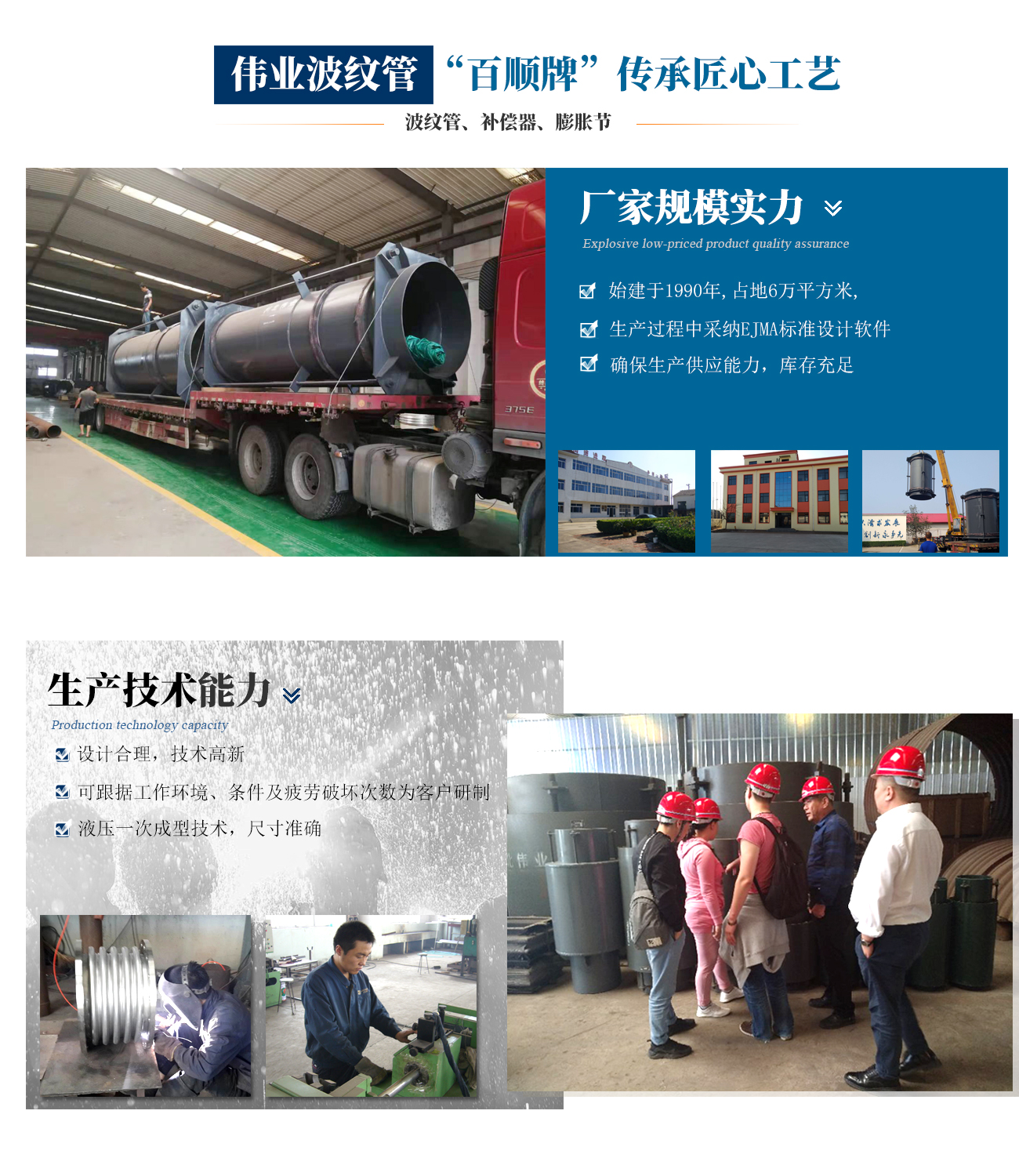

公司动态

这些荣誉既是对伟业波纹补偿器的肯定,也是对河北伟业的鞭策,今后公司将继续贯彻诚信营商之道,在“以诚取信,以信取誉,以誉取益”的基础上,诚信服务客户,再接再厉,再上新台阶。

2020/5/4 9:58:51

行业资讯

发布时间:2022/10/17 15:30:26

发布时间:2022/10/5 10:47:47

发布时间:2022/9/21 15:06:11

发布时间:2022/9/13 14:35:30

采购指南

发布时间:2022/10/13 15:19:42

发布时间:2022/9/26 10:49:15

发布时间:2022/9/19 16:10:55

发布时间:2022/9/15 16:37:20